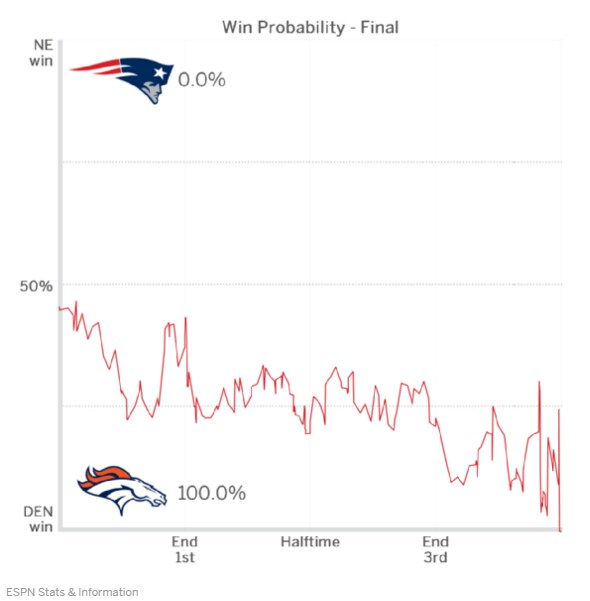

I bought three accounting firms within 12 months. Every single week I picture a ‘win probability graph’ that changes like a live NFL game:

In order to buy Appletree in late 2021 I quit my job, used 80% of our savings, and signed a personal guarantee on a big SBA loan. And we’d just moved across the country…and had a 3rd kid….and my wife was on maternity leave.

If it goes well, it will provide a great lifestyle for our family and build wealth that wasn’t possible in any W2 job. If it fails, we’ll lose every penny we saved and be bankrupt. Seems very risky on paper.

Here’s to de-risk acquisitions and limit your downside:

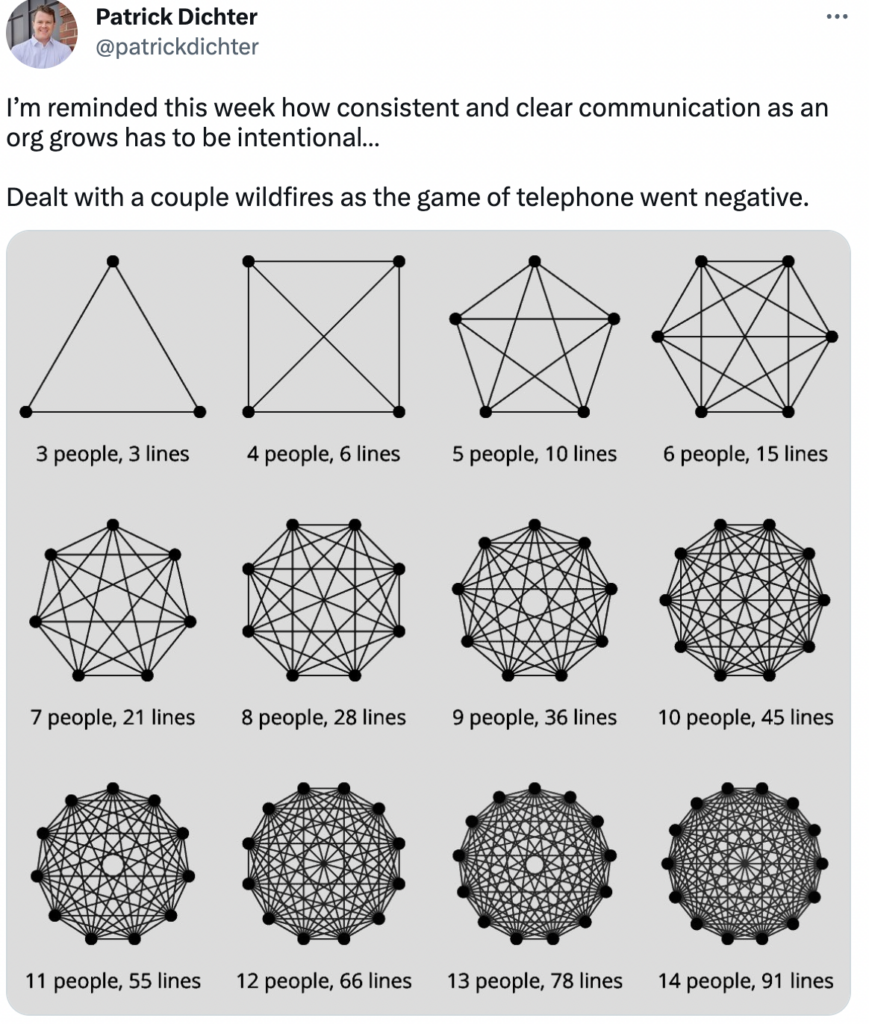

- *Have a clear communication plan with clients and staff

- I literally had this blog ready to publish last week, and one of the acquisitions suddenly went sideways within a few hours. All the biggest clients are friends and nearly left. It felt like my win percentage dropped to 0% as $35k/mo in revenue hung in the balance.

- We should’ve been more clear with the transition plan and timing with the previous owner, and a lot of trust evaporated.

- Deal Structure

- Use seller financing for 15-35% of the acquisition price. It can be reduced and/or forgiven if revenue declines the first 12 months. This aligns interests on a smooth transition and limits debt payments if the business shrinks significantly.

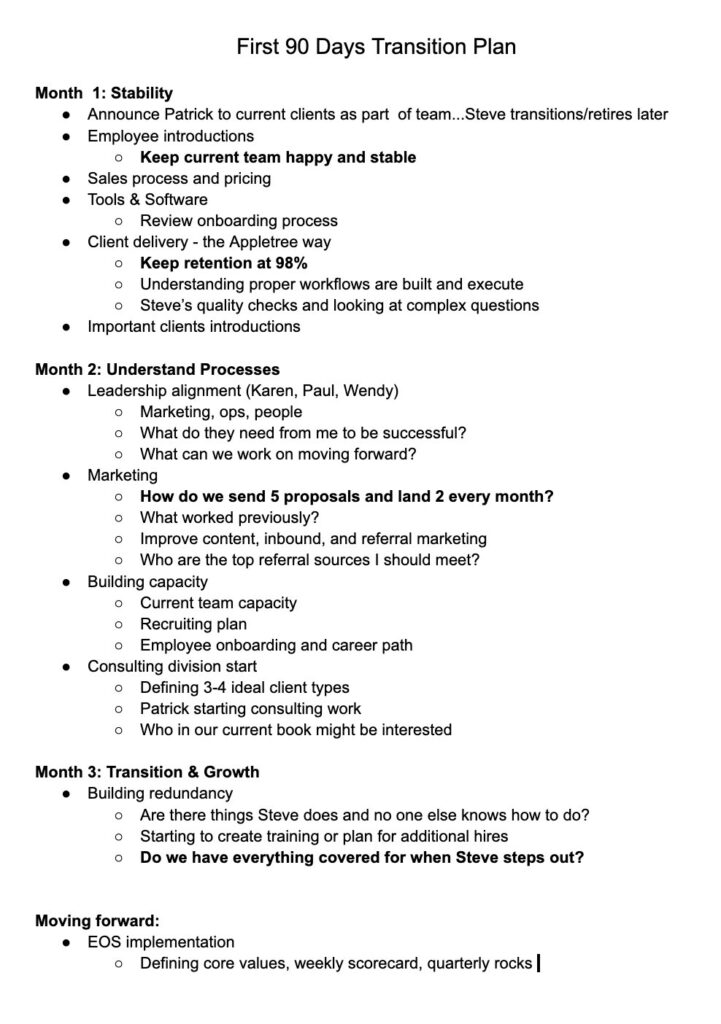

- 90 Day Transition Plan

- The first few months can be chaotic. Have a plan, share with the seller, meet weekly.

- We have an amazing team at Appletree and keeping them in place was key.

- Here’s my outline:

- Derisk people and systems ASAP

- If there’s only one person that knows how to do certain tasks you have a big problem.

- I get along well with all 3 prior owners, but I’ve had to systematically get operations, sales, IT, hiring, decision making out of their head and into mine or another team member

- Prepare to get punched in the face. We had a tax manager quit 45 days in during the height of tax season

- Drive sales!

- Most acquisition entrepreneurs will see profitability decline post close – debt service, higher expenses, previous owner under investing.

- Driving new business will breathe cash into operations.

- I sold more MRR in months 4 and 6 than the previous owner did the prior year

- Build trust with the team and follow through

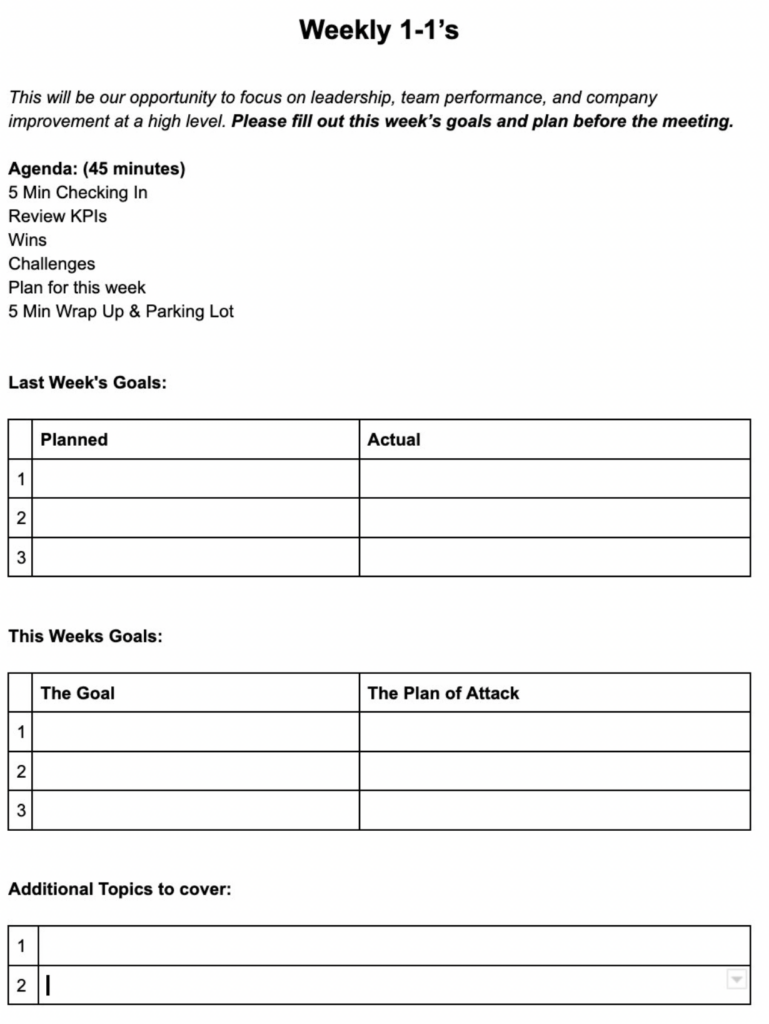

- Know your team on a personal basis, have weekly 1-1’s, recognize top performers, invest in tech/tools to make their job easier, and do a lot of listening.

- Realize it’s an emotional roller coaster

- Some weeks my win percentage feels like 5% and I made a huge mistake. Other weeks times I feel like I won the super bowl.

- I lean on friends in the industry or other acquisition entrepreneurs.

- I also have a STUD wife who’s super supportive

- Be ready to jump on opportunities

- I bought 2 more firms ahead of my planned time frame; I also launched a consulting division and hired 2 great teammates I got introduced to. It felt scary initially, but the additional contribution margin helps the overall business and it’s worked out well.

- Get in the game with your first acquisition and opportunities will come to you.

Now 15 months in it feels like my win percentage is 75%. Monthly recurring revenue is up 200%, EBITDA is healthy, we’re hired to create capacity. But I won’t be totally out of the woods for another 2 years until we’ve been through more tax seasons and paid down some debt.