A growing small business eats cash. Nom nom nom all the way to mature stability. And like my kids it probably wants to eat cash unexpectedly and snack at inconvenient times. Up until $3-5M in revenue there’s a few F bombs to avoid along the way. These F bombs are financial setbacks that will either will mean failure to launch or you’ll catch on fire.

Alright that’s enough kids and rockets analogies. Let’s talk about how to improve the financial health of your small business.

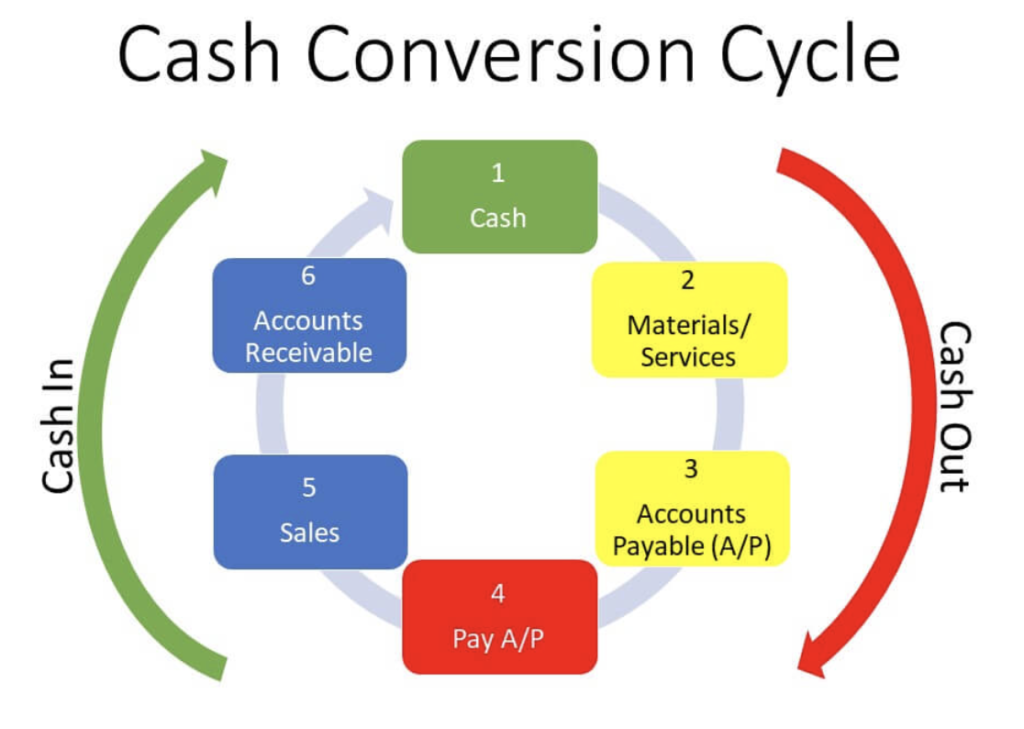

- 1. Quick cash collection. This is the first slippery slope of a growing service business – clients start to get bigger or slow pay you, but your payroll and overhead doesn’t slow down. SO, you need to bill more up front, be strict with installment payments, and your accounts receivable should have a process to set reminders.

- 2. Healthy gross profit margin. (Gross profit vs net profit defined). When you start all revenue looks the same, your overhead is low, and your key employee (aka you the owner) is very efficient. But as you hire other people to do the work and have overhead, you need to manage this closely by measuring it, raising prices, and creating processes. A healthy gross profit margin in home services is +50% and in professional services +40%.

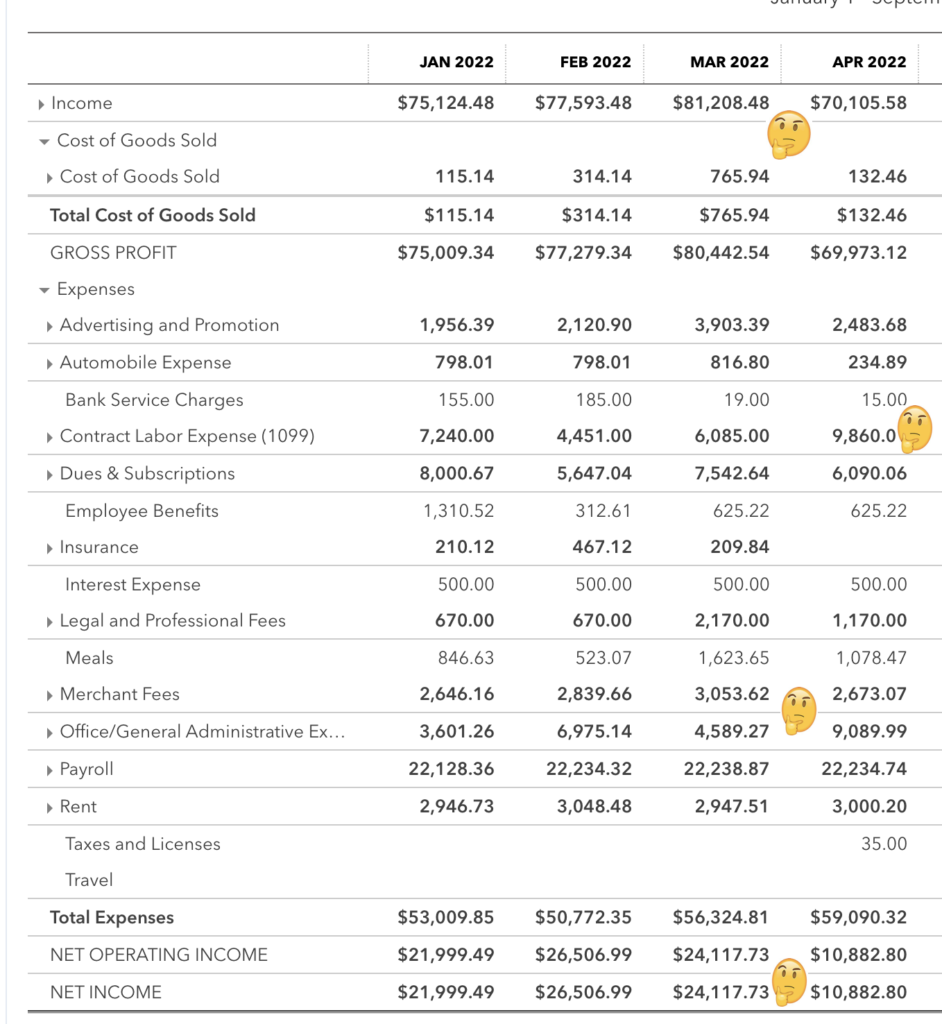

- 3. Spot monthly trends. My #1 favorite report to run in Quickbooks online: Reports > Profit & Loss > Last 12 months > monthly totals. Look for large swings month to month and just follow your nose. You’ll either find symptoms of issues in your business or bad bookkeeping. You don’t need to be a forensic accountant to see labor jumped 40% one month, software subscriptions are adding up, or net profit was negative when you took your eye off sales going to Burning Man.

- 4. Save 2-3 months cash. I.e. If your monthly expenses average $40k, then have $80k in cash. It’ll help you sleep better at night and be a buffer. If you can’t maintain at least 1 month’s worth there’s big issues to solve.

- 5. Use credit when necessary. If you’re a marketing agency and always buy client ads or you’re a landscape design company and always have materials – a credit card can give you a nice 30 day float on regular expenses. Even a line of credit with your bank can be useful when you’re in growth mode and cash flows are lumpy. Credit cards and lines of credit should be paid off within 30 days.

- 6. Pay quarterly tax estimates. It sucks….just pay it. Nothing like a massive cash outlay for a surprise tax bill in April to mess up the financial health of your business.

- 7. You still need leading indicators. Ok we’ve covered the whole cash conversion cycle. Here’s the thing – your Profit & Loss Statement and your bank account balance are LAGGING indicators; they give you data 30-60 days later. You still need LEADING indicators to help you keep a tighter pulse on your business health. Track weekly numbers such as proposals sent, pipeline value, # of projects waiting to kickoff, average days to completion, Accounts Receivable, Google reviews, etc.

Not only will putting these into action help you have better financial health in your business, they’ll actually help you start to see what your growth levers are so you can act on them with data vs hoping a risky bet works out.